maine property tax calculator

The property tax credit established by the state of maine pursuant to 36 mrsa. Municipal Services and the Unorganized Territory.

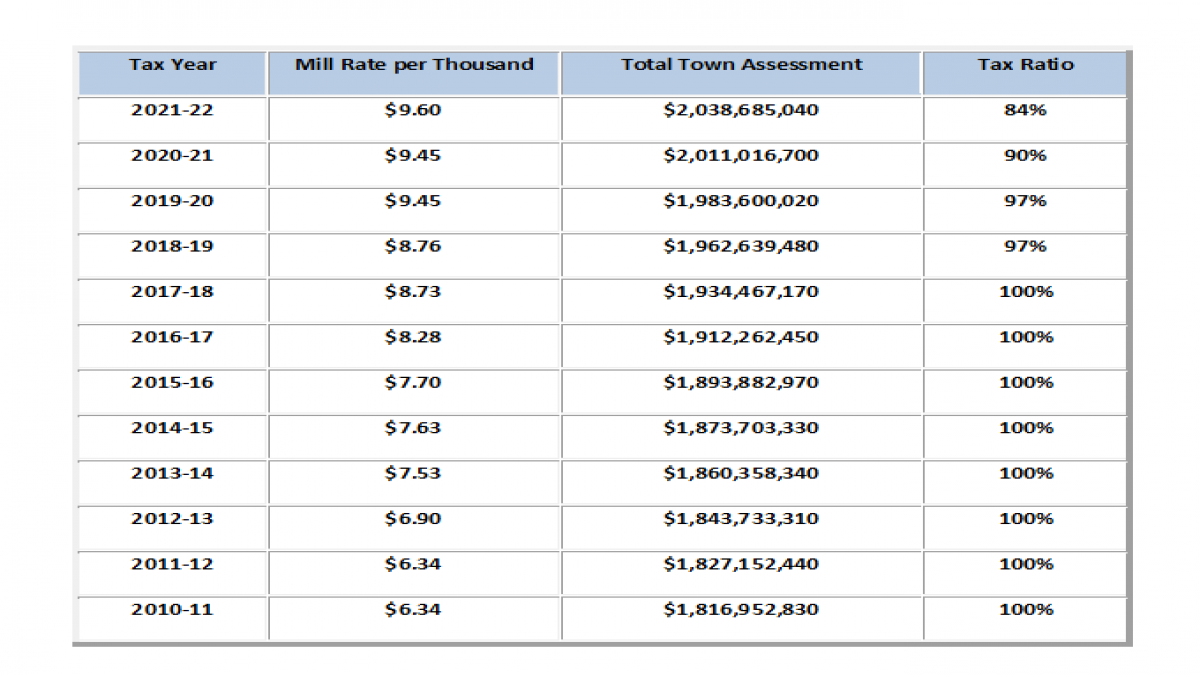

Tax Rates Town Of Kennebunkport Me

The current rate for transfer tax is 220 per every five hundred dollars of consideration.

. Your average tax rate is 1198 and. This state sales tax also applies if you purchase the vehicle out of state. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

The benefit for this credit for single filers is 750 depending on filing status and the number of exemptions claimed. The Property Tax Division is divided into two units. Generally property taxes are higher in the more southern and urban counties in Maine.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in york county. It is important to note that closing costs can vary widely depending on the mortgage and lender you choose. Some areas do not have a county or local transfer tax rate.

You can enter amounts into the text fields or drag the sliders to the correct amount. Married filers no dependent with a combined annual income of. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

Maine Income Tax Calculator 2021. Ad Get a Vast Amount of Property Information Simply by Entering an Address. The median property tax on a 24840000 house is 260820 in the United States.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

Estimate your monthly payments what you might need for a down payment and mortgage insurance at closing using the calculator below. Maine is ranked number twenty out of the fifty states in order of the. The transfer tax is customarily split evenly between the seller and the purchaser.

This income tax calculator can help estimate your average income tax rate and your salary after tax. The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. The second variable is how much your property is assessed at.

The countys average effective property tax rate of 100 is the lowest in the state and well below the state average of 130. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. For example if you purchase a new vehicle in Maine for 40000 then you will.

The following is a list of individual tax rates applied to property located in the unorganized territory. Excise tax is an annual tax that must be paid prior to registering your vehicle. This calculator is for the renewal registrations of passenger vehicles only.

Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. In those areas the state transfer tax rate would be 300. Delaware DE Transfer Tax.

The Maine Property Tax Fairness Credit is available to low-income homeowners who paid property tax on a primary residence in the past year. The car sales tax in Maine is 550 of the purchase price of the vehicle. Property tax fairness credit program.

The state income tax rate in Maine is progressive and ranges from 58 to 715 while federal income tax rates range from 10 to 37 depending on your income. If you make 70000 a year living in the region of Maine USA you will be taxed 11762. These rates apply to the tax bills that were mailed in August 2021 and due October 1.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Cumberland County. The median property tax payment in the county is just 1433. This calculator will estimate the title insurance cost and transfer tax for 1-4 unit residential properties.

For comparison the median home value in Maine is 17750000. Each spending category below corresponds to a Town budget category. 109 of home value.

Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Maine local counties cities and special taxation districts. You Can See Data Regarding Taxes Mortgages Liens Much More.

As many of you probably already know the mil rate is only one of the equations in determining how much youd pay in property taxes. The average rate in Maine is 109 18th in the country. Maine has a number of tax credits that benefit taxpayers in certain situations.

Property taxes are 351 of income in Maine 17th highest in the country. Tax amount varies by county. This means that the applicable sales tax rate is the same no matter where you are in Maine.

The median property tax on a 24840000 house is 270756 in Maine. Maine has a withholding tax that is payable upon the sale of. The median income in Maine is 56277.

The amounts shown are based on percentages derived from the approved FY19 Town of Hampden budget. The State of Delaware transfer tax rate is 250. Property tax rates in maine are well above the us.

Showing 1 to 498 of 498 entries. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property. After a few seconds you will be provided with a full breakdown of the tax you are paying. Maine residents seeking low property tax rates might want to consider Hancock County.

A single filer in Maine who earns 57000 per annual will take home 4461515 after taxes. Its pretty fascinating to see the growth rate over the past several years. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

The state valuation is a basis for the allocation of money.

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Old Farm

Maine Property Tax Calculator Smartasset

518 Center St Real Estate Residential Jetted Tub

Maine Property Tax Calculator Smartasset

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds In 2021 Colonial Renovation Insulation Closed Cell Foam

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Term Structure Of Interest Rates Theories Bbalectures Business Articles Interest Rates Term

6405 Barton Road Virtual Tour Real Estate Outdoor Structures

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property Bu Sell House Fast Property Buyers Property For Rent

Harjeet Is All Set To Purchase A Two Bedroom House In Mumbai And He Faced A Situation Most Homebuyers Generally Face Life Insurance Policy Life Insurance Loan

Walmart Lowe S Among Big Retailers Scheming To Avoid Maine Property Taxes Beacon Property Tax Walmart Tax

Lot 1 Bunkertown Road Country Roads Acre Tours

8194 Farm Road 71 E Real Estate Real Estate Listings House Styles

623 Main Street Commercial Property Real Estate Tours

U S Cities With The Longest Names University Of Rhode Island Names Spelling Bee